Not known Factual Statements About Paul B Insurance

Wiki Article

What Does Paul B Insurance Mean?

The thought is that the cash paid in cases with time will certainly be much less than the overall premiums gathered. You may really feel like you're throwing money out the window if you never submit a case, yet having item of mind that you're covered on the occasion that you do suffer a significant loss, can be worth its weight in gold.

Envision you pay $500 a year to insure your $200,000 residence. This indicates you've paid $5,000 for residence insurance coverage.

Since insurance policy is based upon spreading the threat among many individuals, it is the pooled money of all individuals paying for it that permits the business to develop possessions as well as cover claims when they occur. Insurance is a business. Although it would certainly be good for the firms to just leave prices at the same degree constantly, the reality is that they need to make enough cash to cover all the potential insurance claims their policyholders might make.

All About Paul B Insurance

just how much they got in premiums, they should modify their prices to make money. Underwriting adjustments as well as price rises or decreases are based upon outcomes the insurer had in previous years. Depending upon what business you acquire it from, you might be managing a captive agent. They market insurance coverage from just one business.

The frontline people you handle when you purchase your insurance coverage are the agents and brokers that stand for the insurance provider. They will certainly discuss the type of items they have. The restricted agent is a rep of just one insurance provider. They a knowledgeable about that firm's items or offerings, but can not talk towards various other business' policies, rates, or product offerings.

They will have access to even more than one business and must understand about the series of items used by all the business they represent. There are a couple of essential questions you can ask on your own that may help you decide what sort of insurance coverage you need. Just how much danger or loss of money can you think on your own? Do you have the cash to cover your prices or financial debts if you have a crash? What concerning if your home or auto is wrecked? Do you have the savings to cover you if you can't work as a result of a mishap or illness? Can you manage higher deductibles in order to decrease your costs? Do you have unique needs in your life that need added protection? What issues you most? Plans can be tailored to your demands as well as identify what you are most anxious about safeguarding.

The Ultimate Guide To Paul B Insurance

The insurance policy you require differs based upon where you go to in your life, what kind of assets you have, and what your long term goals as well as tasks are. That's why it is essential to put in the time to review what you desire out of your plan with your representative.

If you obtain a car loan to get a car, and after that something takes place to the auto, space insurance policy will certainly repay any type of part of your finance that typical vehicle insurance doesn't cover. Some lending institutions need their debtors to bring gap insurance.

The primary function of life insurance coverage is to offer money for your beneficiaries when you pass away. Depending on the kind of policy you have, life insurance can cover: Natural deaths.

The Buzz on Paul B Insurance

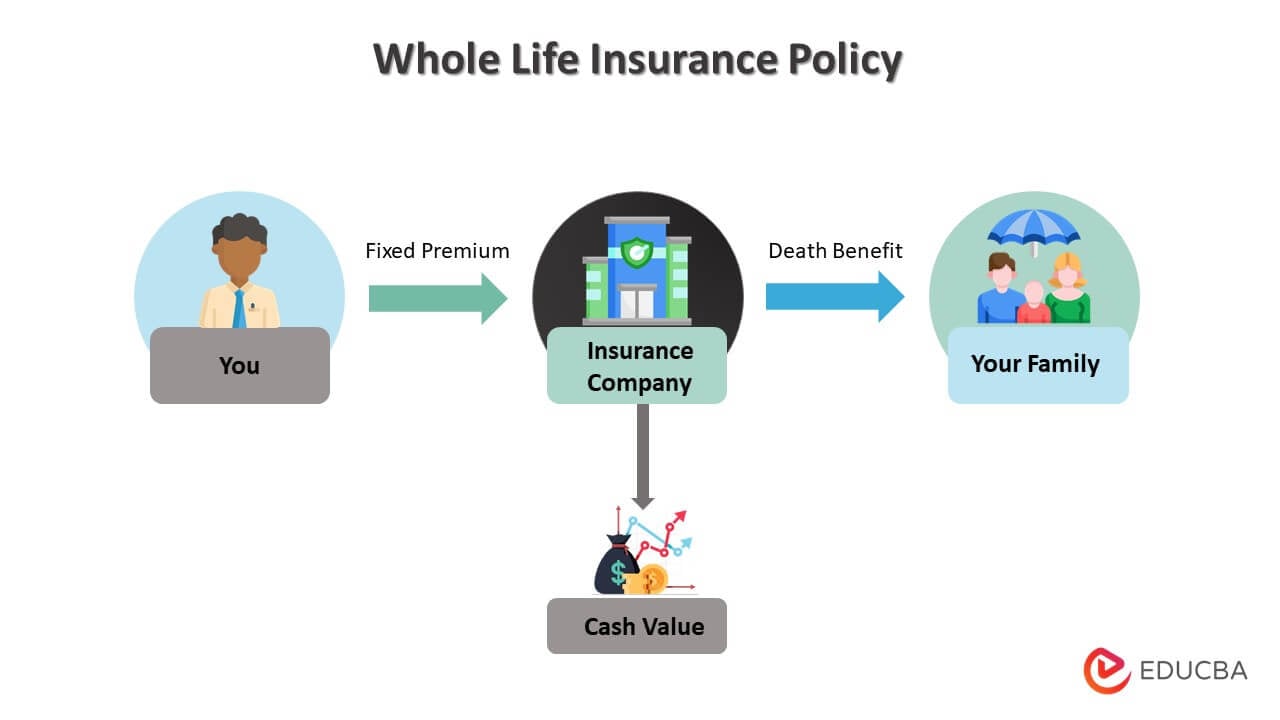

Life insurance covers the life of the guaranteed person. The insurance policy holder, who can be a various individual or entity from the insured, pays premiums to an insurer. In return, the insurance company pays a sum of cash to the beneficiaries detailed on the policy. Term life insurance policy covers you for an amount of time picked at purchase, such as 10, 20 or thirty years.

Term life is popular due to the fact that it supplies large payments at a lower price than permanent life. There are some variations of normal term life insurance policy plans.

Permanent life insurance policies develop money worth as Web Site they age. A part of the costs settlements is contributed to the cash money value, which can earn interest. The cash value of whole life insurance coverage policies grows at a set price, while the money great post to read value within universal policies important site can vary. You can use the cash value of your life insurance policy while you're still active.

Not known Factual Statements About Paul B Insurance

$500,000 of whole life protection for a healthy 30-year-old lady costs around $4,015 every year, on average. That exact same degree of protection with a 20-year term life plan would cost a standard of concerning $188 annually, according to Quotacy, a broker agent company.

Nevertheless, those financial investments come with even more risk. Variable life is an additional permanent life insurance policy option. It seems a whole lot like variable global life but is actually various. It's a different to whole life with a fixed payout. Insurance policy holders can make use of investment subaccounts to grow the cash money value of the plan.

Below are some life insurance fundamentals to assist you better understand how coverage functions. For term life policies, these cover the expense of your insurance coverage and administrative prices.

Report this wiki page